Does the Spring Market Really Exist in Kansas City?

Does the Spring Market Really Exist in Kansas City?

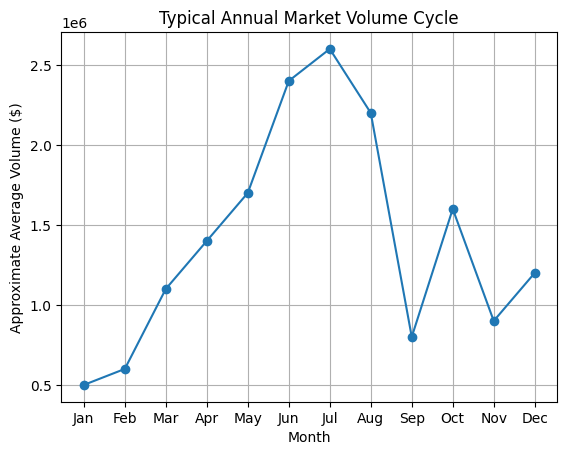

Everyone loves to talk about “the spring market” like it’s a magical switch that flips the second we get a 60-degree day. But is it real, or is it just something we say because it sounds good in a listing presentation? I pulled my own personal selling history from the last five years and mapped out monthly volume to see if there’s actually a market cycle hiding under the noise. Spoiler: there is. It’s not always dramatic, and it doesn’t hit on the same exact date every year, but the rhythm is surprisingly consistent. Think of it less like a perfect calendar and more like a pattern: momentum builds, activity peaks, things cool off, then the market resets and gets selective again.

Why Volume Matters More Than Headlines

Most market conversations focus on price. What often gets missed is volume.

Volume tells us how confident buyers and sellers actually are. Prices can stay flat while conviction changes dramatically underneath the surface. When volume rises, decisions speed up. When volume drops, the market isn’t broken. It’s selective.

Understanding volume helps explain why two months with similar prices can feel completely different.

What This Chart Is Really Saying

The “market cycle” chart is basically the market’s heartbeat over a typical year. Activity does not stay steady. It has a rhythm. Things usually start slow after the holidays, then momentum builds in spring as more people list and more buyers get serious. By early summer the market is moving at full speed, and that is often when volume hits its peak because everyone is trying to make things happen before vacations and school schedules take over. Then, almost like clockwork, things cool off in late summer and early fall. That does not mean the market is “bad” or “crashing.” It just means the frenzy fades and the market gets pickier. And by the end of the year, you are left with fewer people in the mix, but the ones still showing up usually mean business.

The Five Phases of a Real Estate Year

You can use this framework every year, whether you’re buying, selling, or just trying to make sense of what you are hearing.

Phase 1: The Quiet Build (January to March)

This is the market stretching after the holidays. Volume is lower, but that doesn’t mean nothing is happening. It means the casual people are out and the serious people are paying attention. Buyers are watching new listings closely because competition is usually lighter. Sellers are getting the house ready, talking to lenders, and testing the waters. It’s also when the market starts quietly picking its direction for the year. If you like less noise and a little more breathing room, this phase is underrated.

Who wins: Buyers who want less competition, and sellers with a move-in-ready home priced correctly.

Phase 2: The Acceleration Window (April to May)

This is when the “spring market” starts to look real. Volume climbs fast because more homes hit the market and more buyers decide it’s go-time. Things move quickly, but it’s not always chaos yet. This window is often the most balanced stretch of the year. Sellers have the advantage of attention and momentum. Buyers still have a chance to negotiate without feeling like every house is a prize fight. If you want the best mix of selection and predictability, this is usually it.

Who wins: Balanced, with a slight edge to sellers. Great for smart buyers who are prepared.

Phase 3: The Peak (June to August)

This is the loud part of the year. Volume is usually at its highest, and so are emotions. Buyers feel the pressure of timelines, summer schedules, and the fear of missing out. Sellers feel confident because demand is obvious and showings are stacked. The market can be incredibly strong here, but it can also get a little irrational. This phase is great for visibility and activity, but not always for calm decision-making. The key is having a clean strategy, because small mistakes get expensive when the market is moving fast.

Who wins: Sellers, especially those who want maximum attention and speed.

Phase 4: The Reset (September to October)

After the summer rush, reality returns. Volume often drops or gets choppy, and the market gets pickier. Buyers slow down and start asking better questions. Sellers either adjust expectations or sit tight until next year. This is where negotiation leverage starts to reappear, not because the market is broken, but because urgency fades. If you’re a buyer who likes to move thoughtfully, or a seller willing to price correctly and stand out, this phase can be a sweet spot.

Who wins: Buyers, especially those who like negotiating and moving without the frenzy.

Phase 5: The Intentional Market (November to December)

This is the “only the motivated” season. Fewer people are shopping, fewer homes are listed, and the pace is quieter. But the people still in the game usually have a reason: relocation, life changes, timelines, or a real plan. That often makes the conversations cleaner and the negotiations more direct. This phase doesn’t get the hype, but it’s where good deals and smooth transactions can happen, especially when everyone else is distracted. And the activity that does happen here often sets the tone for January and February.

Who wins: The prepared. Motivated buyers and realistic sellers can both do very well here.

Market Myth of the Month: “If volume is up, the market must be getting hotter.”

Not necessarily. High volume can mean confidence, but it can also mean chaos. Some of the biggest volume months show up right before the market cools off, because peaks often happen when everyone rushes in at once. Volume tells you activity is high, not that prices will keep climbing. The better question is: are we in steady momentum, or are we at the top of the roller coaster right before the drop?

What This Means for Kansas City Buyers and Sellers

If you’re buying in Kansas City, Overland Park, Prairie Village, Leawood, Lenexa, Shawnee, or Olathe, timing is not about “guessing the market.” It’s about understanding what the market is likely to reward during each phase.

If you’re selling, the best move is not always to chase the peak. Sometimes the best results come from being early, priced right, and positioned correctly before the crowd hits.

If you’re buying, the best move is often preparation. The buyers who win are not the ones who “try harder.” They’re the ones who are ready when the market turns.

So …

At the end of the day, the market isn’t random. It just isn’t polite enough to follow a perfect calendar. Volume tends to move in a rhythm, and once you know what phase you’re in, things make a lot more sense. The goal is not to time it perfectly like we’re day-trading houses. It’s to make smarter decisions with better expectations. If you’re thinking about buying, selling, or you’re just curious where we are right now in the cycle, shoot me a message. I’ll tell you what the numbers are actually saying, and what I’d do if it were my own home.

Want a quick read on the current Kansas City market cycle and what it means for your neighborhood? Reach out and I’ll give you the honest version, tailored to your timeline and your price point.

f.a.q

Does the spring market exist in Kansas City?

Yes, in the sense that volume and activity usually build from March through May. It is not a single date, but a recurring pattern.

What is real estate volume?

Volume is the amount of homes being sold and the total dollar amount moving through the market. It’s a strong indicator of participation and confidence.

Does higher volume mean prices will go up?

Not always. Volume often peaks before the market cools, so it can signal a transition as much as strength.

What months are best to sell a house in Kansas City?

In many years, the strongest activity is late spring through summer, but the best result depends on pricing, condition, and strategy. Being early and well-positioned often beats being late and competing with everyone.

What months are best to buy a house in Kansas City?

Buyers often find more negotiating leverage in early year and early fall, but the best month depends on inventory and your readiness.